Lazard, solar and your energy costs

Is rooftop solar worth it?

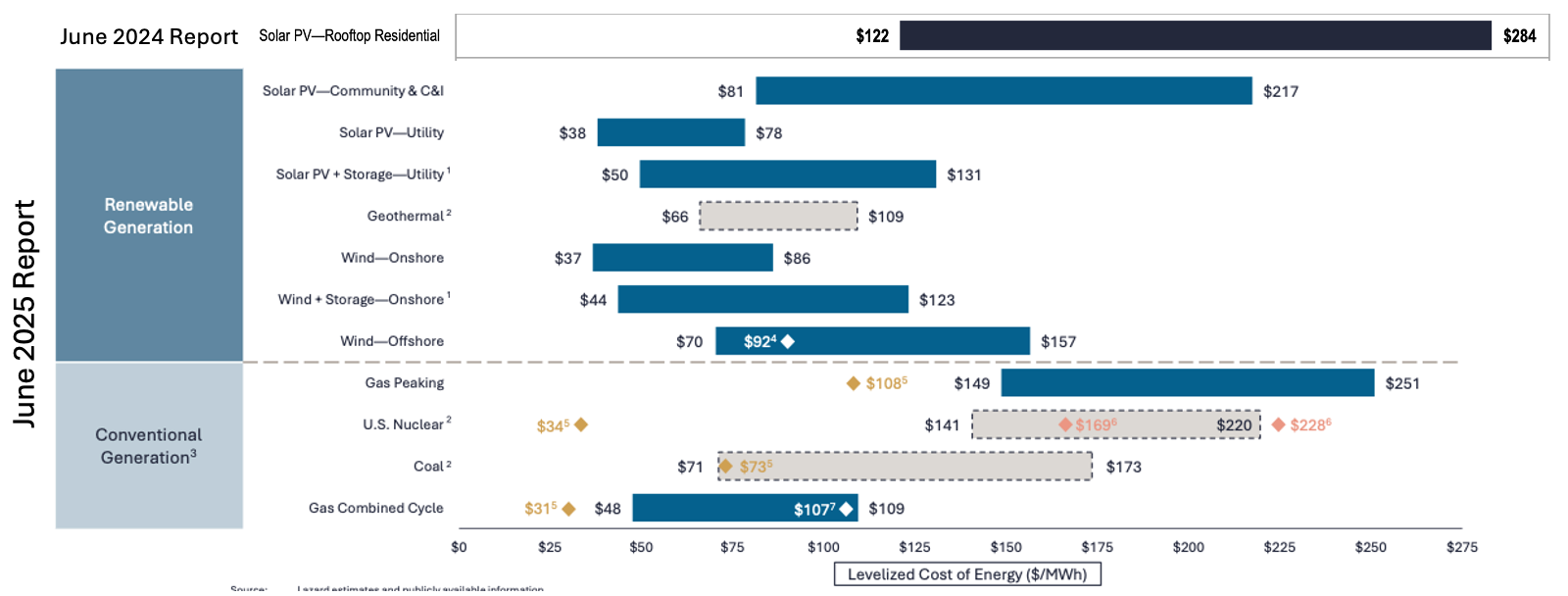

Last week Lazard, the financial advisory firm, put out their latest report on the “Levelized Cost of Energy”, LCOE, comparing costs of various energy sources. Utility-scale wind and solar is cheapest, ‘gas peaking’ is the most expensive, and interestingly they dropped rooftop solar, which in the 2024 report was the most expensive source! As I’ve started to learn about and dig in to the energy space, it got me wondering - how can that be?

There’s a few missing ingredients to LCOE - that are discovered by answering these questions:

Why is rooftop solar so much more expensive than utility solar?

-- AND --

Why is what I pay at home so much more than Lazard’s LCOE?

There’s pretty clear answers to each of these.

Answer #1, Rooftop Solar Costs More - Nearly 1/3 of the cost of rooftop solar goes to solar installer sales (customer acquisition) costs and profit/overhead. Whereas, the utility has no “sales” cost on a solar farm (if they build it themselves), and they have other places in their business to allocate overhead. Utilities also have economies of scale.

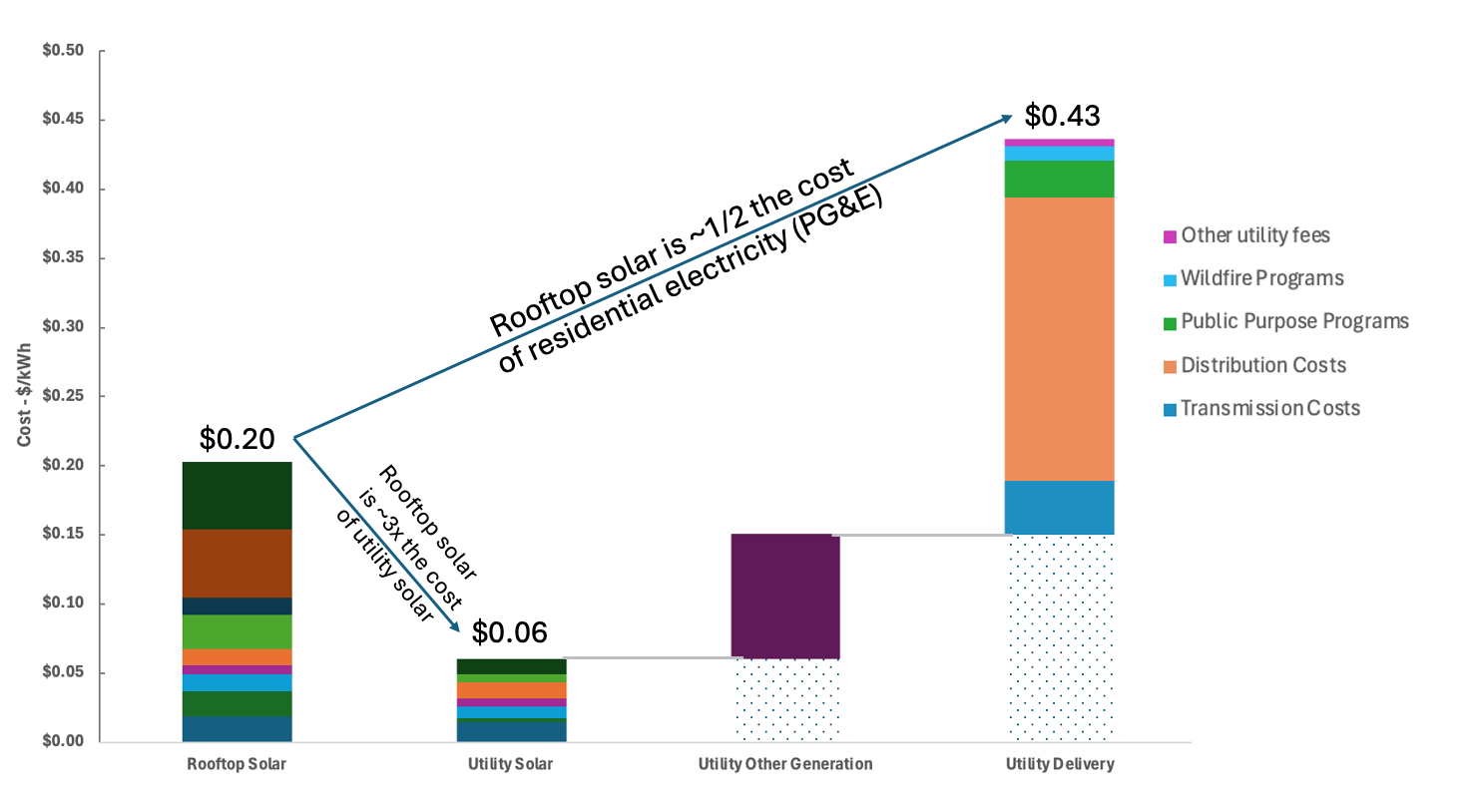

Answer #2, Retail Electricity Costs Even More - There’s another huge chunk of costs to delivering electricity from the utility solar farm to our houses - the transmission, distribution, other costs and profit - all the stuff outside of actual generation - almost triples the cost for electricity by the time it reaches you and me. With rooftop solar you bypass all this.

The bottom line is that Lazard’s 2024 “expensive” rooftop solar is still cheaper to you as the consumer of electricity.

Let’s look at this in more detail.

Rooftop solar costs

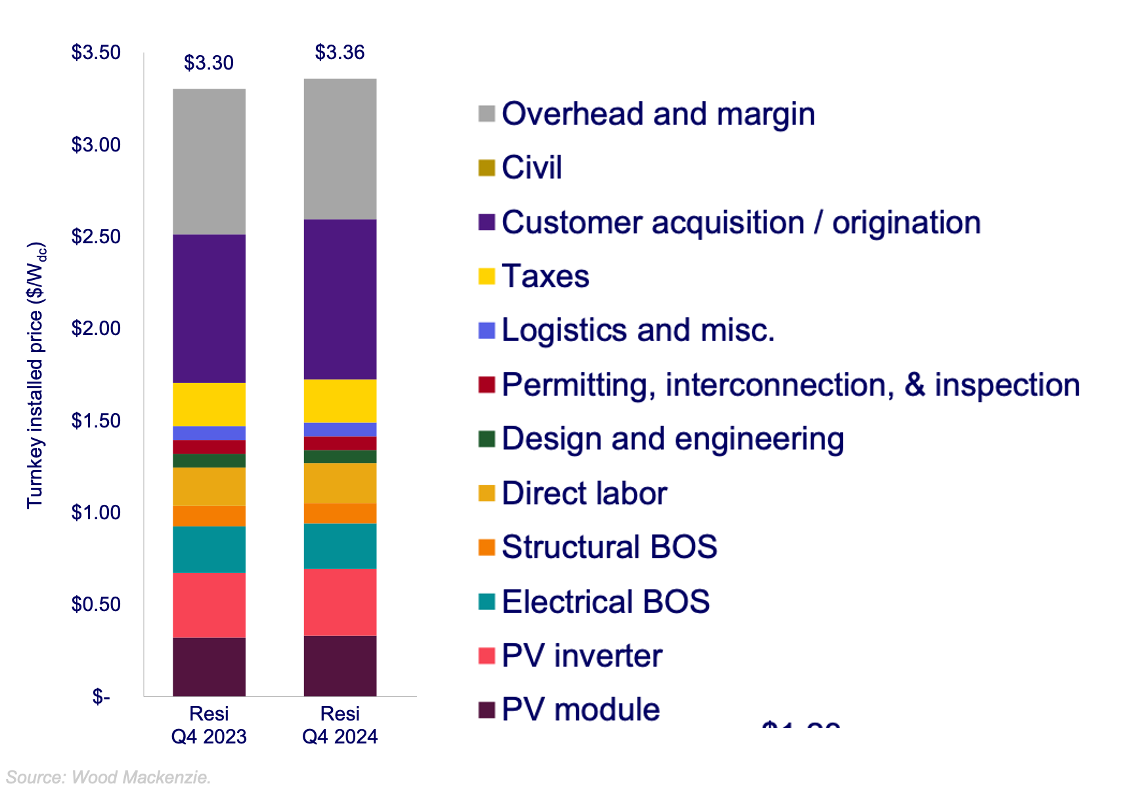

As noted above, sales costs and profit/overhead make up the biggest chunk of what you’d pay for rooftop solar. Wood Mackenzie has a great breakout of costs for solar systems:

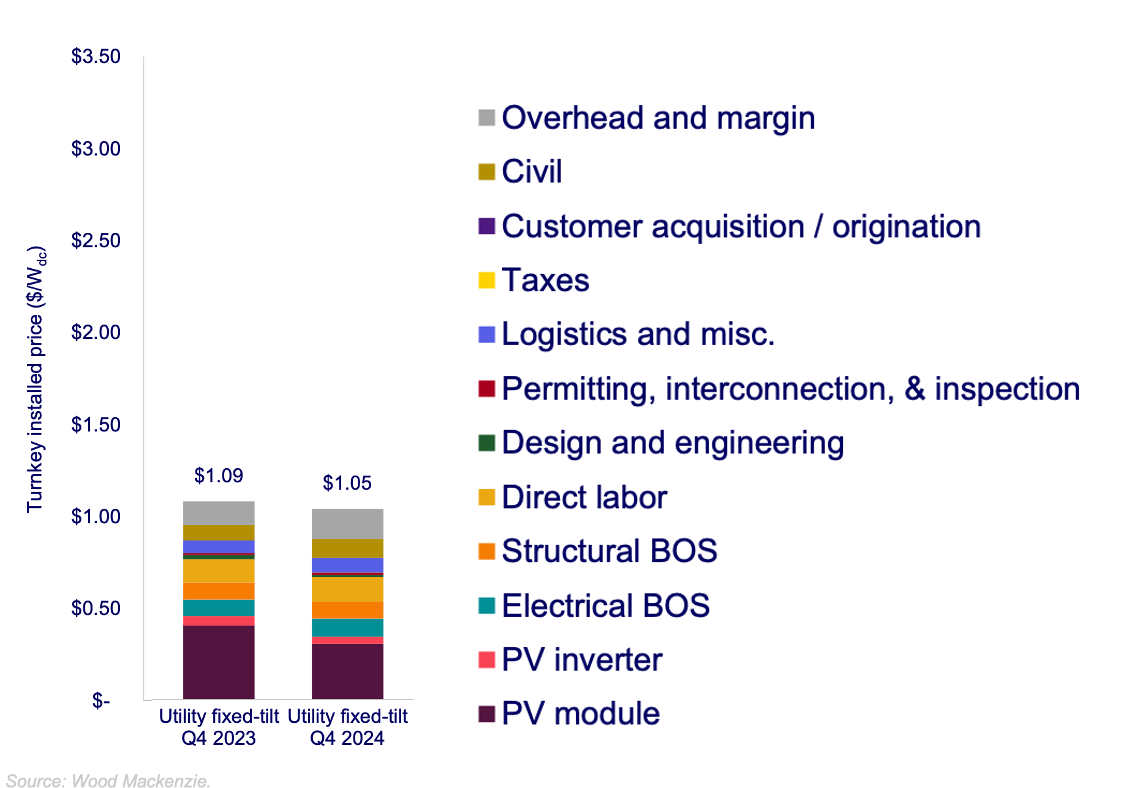

In comparison, utility-scale solar is much cheaper ... even though the solar panels themselves cost about the same!

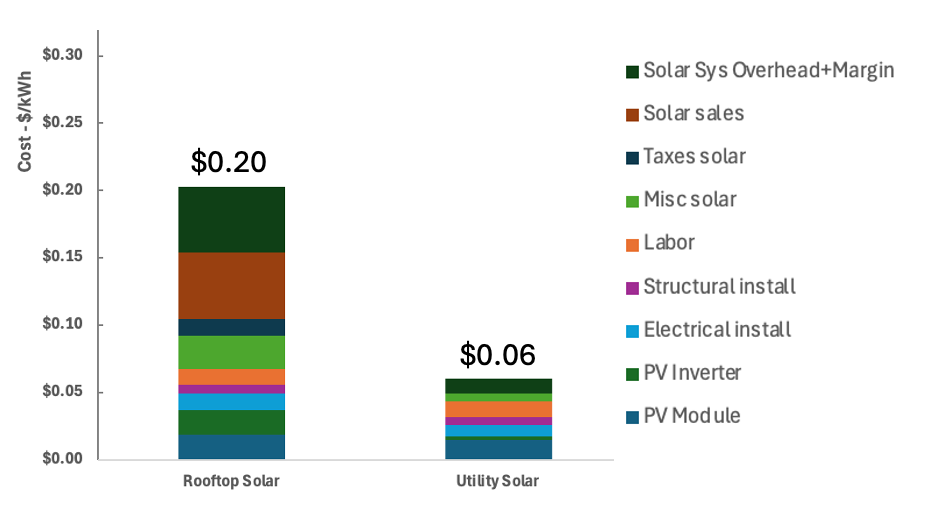

We can then turn these $/watt costs into the equivalent $/kWh costs similar to the Lazard LCOE, here:

With rooftop solar you’re basically paying $0.05/kWh for all those solar salespeople to knock on doors, come to your house and create an estimate, and to close the deal. Then, because residential solar has certain requirements that utility solar doesn’t (safety - rapid shutdown, residential building codes, etc), you have to pay more for the inverters. And lastly, taxes, permitting, direct labor of putting panels on roofs and running connections for a house costs more per watt than building industrial-sized solar farms. But surprisingly you’re not paying more for the solar panels!

Retail electricity costs

But wait - these prices are (maybe) far less than what I pay for electricity - what gives?

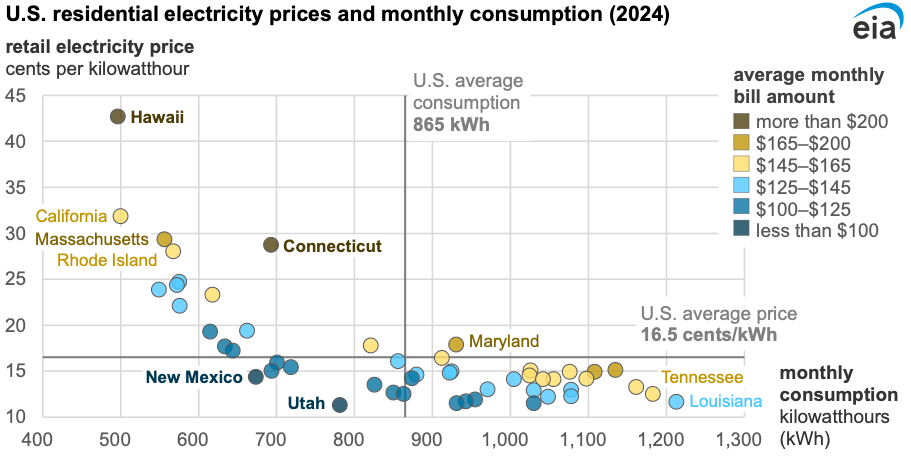

I’ll use my region in California as the example, which has some of the highest electricity rates in the country.

Electricity generation costs

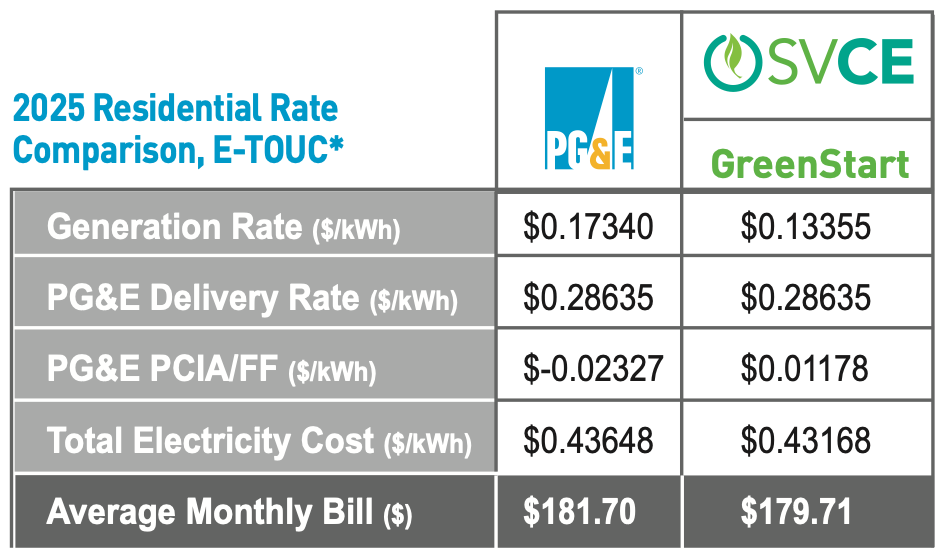

Our electricity provider is PG&E, but we can choose among two generators - either PG&E, or what’s known as a “Community Choice Aggregator“, or CCA. In my area, one of these CCA’s is Silicon Valley Clean Energy (SVCE). They provide a nice comparison of the cost elements of electricity - and yes, these are some expensive rates:

Now it gets complicated - what’s this “PG&E PCIA/FF" item, that adds to the SVCE price but subtracts from the PG&E price?

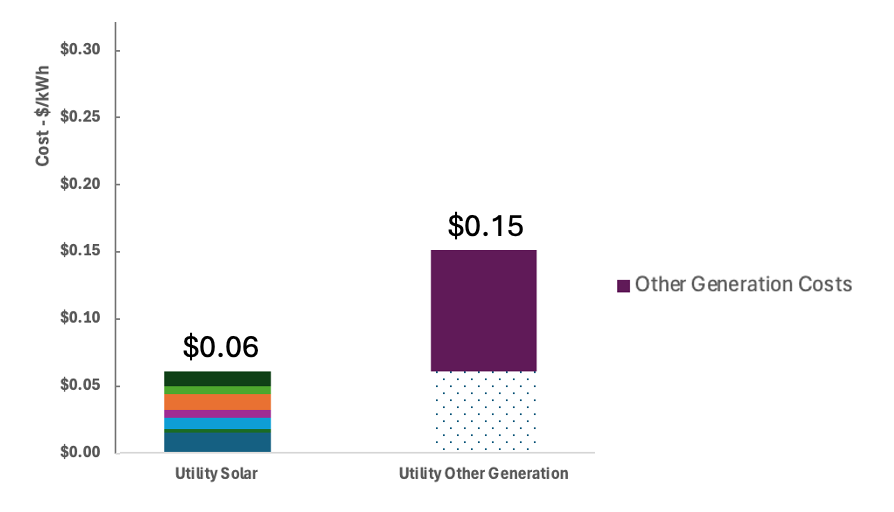

In reality, the PCIA/FF item is part of the cost of generating electricity even though it’s listed separately. To keep electricity running 24 x 7 x 365, you obviously have to rely on many more sources than solar. There’s gas plants that need to be built and run, there’s the Diablo Canyon nuclear power plant, which recently had its life extended (with a $1.4B loan), and many other sources. These other sources in many cases were built when costs were higher (in the case of old solar farms), and there may be higher maintenance costs (for old power plants). Most importantly, there need to be enough power plants built to handle the biggest demand ever - even if that demand lasts just 1 day out of the year. All these costs factor into the difference between the cost of utility solar ($0.06) and the total cost of Generation (~$0.15). The PCIA/FF item is a way to make sure such costs from when PG&E was a generation monopoly are equally allocated among all utility users, regardless of who you choose as your generation provider. So, the overall cost of electricity production looks like this:

Electricity delivery costs

Now let’s look at that other, bigger cost - Electricity Delivery, which is more than $0.28/kWh. Breaking this out from the PG&E tariff, delivery is made up of Transmission (getting power from the power plants), Distribution (getting the power to all our homes and businesses), and other costs. Utility tariffs don’t break out utility company profit, but it’s about 15-20% of the total bill, or ~$0.07/kWh in the case of PG&E (read here how that’s calculated and why it’s probably too high). These $0.28/kWh of delivery costs add up to the total retail price of $0.43/kWh.

Now you can see why two things can be true at the same time:

- Rooftop solar is an expensive way to generate solar electricity BUT

- It still (might be) a lot cheaper than buying it from your utility!

Notes and caveats -

There are a lot of assumptions that go into the above, including:

- Cost and production assumptions for solar including rooftop, pp 34-35 of Lazard report; they assume 8% cost of debt (loans) and 12% return on investment (equity) for energy projects including your home solar.

- Average costs per watt for residential solar. In reality this can vary a lot, anywhere from $2.6/W to $5.9/W depending on region and installer (p 38 by lbl.gov).

- I left out any assumptions of financial incentives (ie, assumes NO tax credits for solar - which would make rooftop solar look 30% better while it lasts).

- Electric tariffs are complicated - Eduardo digs into PG&E residential tariffs more, here.

- Probably other assumptions I’m missing. If you see some or to shoot holes in this, let me know!